T : +82-31-702-1397

F : +82-31-706-1390

E : hwangnco@hwangnco.com

H : www.hwangnco.com

KOREA REPORT - JULY, 2023.

TOPICS.

President Yoon arrived in Vilnius, Lithuania, on 10th, for a three-day trip to attend North Atlantic Treaty Organization summit. SKorea and NATO agreed on 11th to upgrade their partnership by expanding the scope of cooperation from traditional areas such as counterterrorism, disarmament and cyber defense to emerging technologies in artificial intelligence, space and missiles. At a meeting with NATO Secretary-General Jens Stoltenberg, Yoon stressed the need to "institutionalize the framework" to bolster cooperation with the US-led alliance. During the meeting, Individual Tailored Partnership Plan was signed to strengthen comprehensive cooperation between Korea and NATO in 11 areas. The relationship between SKorea and NATO has evolved from Individual Partnership Cooperation Program, the first cooperation document signed between the two in 2012, to the more advanced Individual Tailored Partnership Plan.

During his surprise visit to Kyiv on 15th, President Yoon pledged increased military aid as well as humanitarian support to Ukraine. Yoon had a 65-minute private meeting with Ukrainian President Volodymyr Zelenskyy to discuss pending issues between two countries and a 45-minute extended meeting with key officials from both governments. Two leaders agreed to jointly pursue the ¡°Ukraine Peace and Solidarity Initiative,¡± which encompasses SKorean security aid, humanitarian aid and reconstruction aid. In the field of humanitarian aid, Yoon pledged to provide $150 mil in humanitarian aid this year, following last year's contribution of approximately $100 mil.

The International Atomic Energy Agency on 4th delivered its final verdict on Japan¡¯s planned discharge of wastewater from wrecked Fukushima nuclear power plant, as maintaining safety standards, ending a two-year review conducted amid concerns over its possible impact to marine life and human lives. Concluding that Japanese plan to release the water into the sea was ¡°consistent with the relevant international safety standards¡±, IAEA said that the discharge of treated water ¡°will have a negligible radiological impact on people and the environment.¡± IAEA stressed that its team would have continued presence at the nuclear power plant in Fukushima during and after planned discharges. Read more¡¦

SKorea has been hit by record rainfall from 9th to 16th, resulting in the highest number of casualties in 12 years, according to Central Disaster and Safety Countermeasures Headquarters. Heavy rains have killed at least 22 people and left 14 others missing while causing thousands to evacuate their homes across the country. A total of 4,763 people from 2,715 households had sought temporary shelters. Electricity blackouts were reported in 13 cities and counties. While power has been restored in most places, more than 8,300 households in Mungyeong, Yeongju and Yecheon in North Gyeongsang Province didn't have electricity. Floods swept away crops and roads. 139 roads remain closed, while 384 trails in 19 national parks were closed. Twenty flights had been called off, while 28 vessels on 20 sea routes had been grounded.

Korea and other Asian nations can be key players in the global supply chain, as countries wean off their dependence on China, Korea Chamber of Commerce and Industry said on 5th. Korea and other ¡°Altasia¡± countries can be a substitute for China in global trade scene. The term Altasia is a compound of alternative and Asia, encompassing 14 countries in Asia that could replace China. Vietnam, Thailand and India could contribute with their investment policies. The Philippines, Bangladesh, Myanmar, Laos and Cambodia meanwhile are able to provide low-cost labor. KCCI suggested Korea would particularly excel among the 14 countries in such a scenario.

Korean government revised down its economic growth rate projection to 1.4% on 4th, as exports sector struggles to rebound. Finance Ministry initially suggested that Korean economy would see a rebound in mid-2023, but new forecast has dialed it back to a slow recovery in second half, followed by more growth next year. Finance Ministry suggested a 3.3% consumer price inflation rate for this year, pulling down previous projection by 0.2%.

SKorea logged a trade surplus of $1.63 bil in July, up $500 mil on-month, narrowly avoiding a trade deficit, as falling prices of energy and raw materials pulled imports down faster than exports. Outbound shipments fell 16.5% on-year to $50.33 bil, declining for 10th consecutive month, while inbound shipments fell 25.4% to $48.7 bil. The sluggish exports came as the overseas sales of semiconductors sank 33.6% on-year on falling demand and a drop in chip prices, resulting in a $3.8 bil drop. Shipments to China fell 25.1% on-year to $9.9 bil. Exports to China have been falling for 14 months. Korea's trade balance with China logged a deficit of $1.27 bil, showing a gradual recovery from $2.71 bil deficit in March.

SKorea's Fair Trade Commission said on 3rd that number of conglomerates in the country fell to 81 following takeover of DSME by Hanwha Group. Hanwha clinched a deal to acquire 49.3% stake and managerial control in DSME, with FTC giving final nod to the agreement in late April. DSME was renamed Hanwha Ocean in May. Prior to takeover, DSME was country's 37th-largest conglomerate with combined assets of KW12.3 tril ($9.4 bil). Currently, Hanwha holds 99 affiliates under its wing, with assets estimated at KW83 tril ($63 bil), standing as country's seventh-largest conglomerate.

PERFORMANCE OF SECOND QUARTER

Samsung Electronics¡¯ second-quarter operating profit plunged 95.3% on-year to KW600 bil ($462 mil), the worst quarterly profit in 14 years. It¡¯s revenue declined 6% on-quarter and 22.3% on-year to KW60 tril. Hyundai Motor¡¯s operating profit in second quarter reached KW4.2 tril ($3.3 bil), up 42.2% on-year, to repeat as leading earner among listed companies in the country. The revenue hit KW42.2 tril, up 17.4% on-year, the largest quarterly numbers in the history of the automaker. Read more¡¦

Hyundai Motor Group became second-largest car brand in terms of sales in the US electric vehicles market in first quarter, according to Motor Intelligence on 10th. Following Tesla¡¯s 336,892 units, Hyundai and Kia sold 38,457 units in the first half, up 11% on-year. Hyundai-Kia outpaced General Motors, which was second in EV sales during Jan-June period last year. Volkswagen and Ford Motor Company came in at fourth and fifth place after selling 26,538 units and 25,709 units, respectively.

Hyundai E&C said on 17th that it would join postwar reconstruction project in Ukraine, signing an agreement with Boryspil International Airport Corporation for airport's future expansion project. Boryspil International Airport is the largest airport in Ukraine. Located about 29 km southeast of Kyiv, the airport is responsible for 62% of country¡¯s passenger traffic and 85% of its airborne cargo shipping. Under the agreement, Hyundai E&C will rebuild landing strips and new cargo terminal at Boryspil International Airport. The company is currently conducting a feasibility study on the cargo terminal. Read more¡¦

Korean investors have poured money into Japanese stocks this year, taking advantage of a weaker yen and the roaring Japanese stock market, according to Korea Securities Depository on 3rd. KSD said that Korean investors net purchased $132 mil worth of Japanese stocks in Jan-June period, 1,220% increase on-year. Over 44,000 individual purchases happened, showing 70% increase on-year. The figure is the highest since 2011. Monthly figure also show 14,494 purchases in June, the largest ever, breaking previous record of 7,757 purchases in May. Korean investors held $3.13 bil worth of Japanese stocks, 18% jump from $26.1 bil end of last year. Read more¡¦

Bank of Korea decided to hold the rate at 3.5% at its rate-setting meeting on 13th, keeping the base rate steady since Feb. BOK¡¯s decision falls in line with the market projection as the consumer prices growth in June fell to 2% range for the first time in 21 months.

SKorea's consumer prices showed slowed growth, rising 2.3% on-year in July, according to Statistics Korea. Prices of diesel fell by 33.4%, gasoline by 22.8% and LPG for vehicles by 17.9% on-year in July. Prices of daily necessities advanced 1.8% on-year, lowest in 29 months since Feb 2021. But vegetable prices rose 9.1% on-year, due to the heavy rain. Core inflation climbed 3.3% on-year in July.

From Jan to June this year, global shipyards received newbuilds of 17.81 mil cgt (678 units), down 34% on-year. By country, China received 428 vessels of 10.43 mil cgt (59%), while Korea secured 114 vessels of 5.16 mil cgt (29%), followed by Japan (66 vessels of 1.4 mil cgt, 8%) (in terms of cgt). All other nations collectively accounted for 4% (820,000m cgt) of the orders. Global shipyards secured orders totaling 2.76 mil cgt in June, marking a 49% on-year decrease. By country, China dominated the order sales market in June with 80% (71 vessels, 2.2 mil cgt) of the total orders. SKorea took second place with 22% (10 units, 3.8 mil cgt), followed by Japan with 1% (40,000 cgt). All other nations collectively accounted for 5% (1.4 mil cgt) of the orders.

HD KSOE on 27th released its performance on a consolidated basis from April to June of 2023. HD KSOE posted KW5.4536 tril ($4.17 bil) in sales, KW71.2 bil in operating profit, and KW39.4 bil in net profit for second quarter. Its sales increased 30.2% on-year. Net profit was turned into surplus from a loss of KW151.8 bil seen during first quarter. Operating profit and net profit succeeded in changing surplus from KW265.1 bil loss and KW105.6 bil net loss, respectively. HD KSOE's sales have risen due to increased shipbuilding output and engine delivery, and they anticipate further growth in operating profit during the second half of 2023, owing to higher ship prices.

SHI announced that its 2Q sales for this year amounted to KW1.9457 tril with the operating profit reaching KW58.9 bil. These figures indicate an increase of 21.2% in sales and a doubling of profit by 200.5% compared to first quarter. The sales volume represents the highest figures since 4Q 2019's KW2.1572 tril. SHI attributed the sales hike to increased order volume for LNG carriers and large containerships.

Hanwha Group is reportedly considering acquisition of Australian shipbuilder Austal. According to industry sources and foreign media, Austal is a multinational shipbuilder with shipyards in Western Australia and Alabama, USA. As a prominent player within the defense sector, the company recently bagged a contract totaling $3.2 bil with the US Navy. According to industry sources, Hanwha Group's interest in acquiring Austal is primarily due to its global position and prominence in the defense sector. Read more¡¦

-------------------------------------------------------------------------------------------------------

ATTACHMENT: Korea Report - July 2023 (PDF FILE)

Please let us know if you have difficulty opening the file.

|

IMPORTANT INQUIRY.

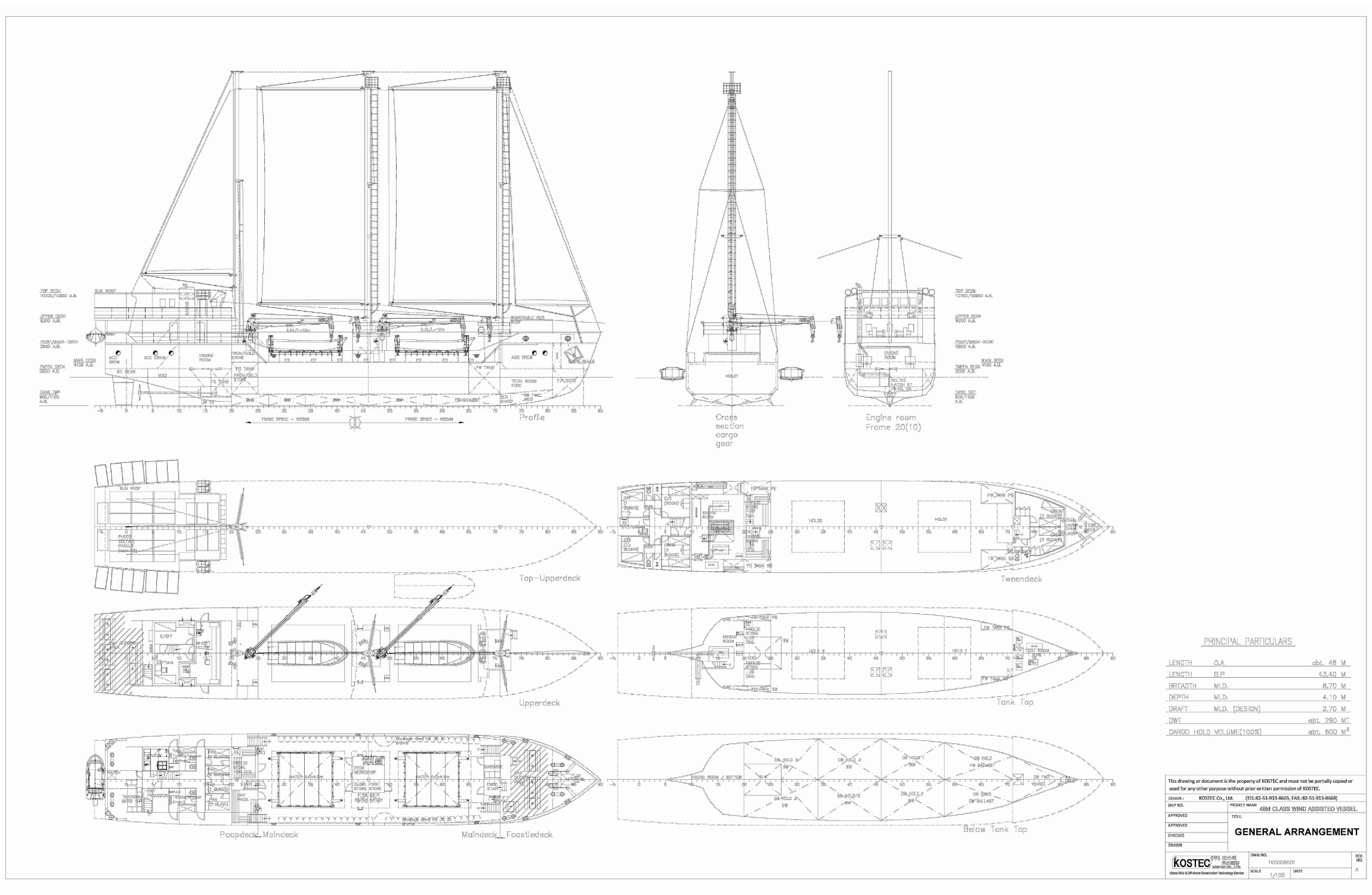

48M CLASS WIND ASSISTED VESSEL.

We have recently been involved in the project which was developed for the islands in the clean water. It is eco-friendly concept combined with most efficient engine with sails, which is ideal for the transportation/commute among the islands in protection of environment.

PRINCIPAL PARTICULARS.

LENGTH : ABT. 48M

BREADTH : 8.70M

DRAFT(DESIGN) : 2.70M

DWT : ABT. 290 MT.

CARGO HOLD VOLUME(100%) : ABT. 600M3

SPEED : 8 KNOTS AT 90% MCR

PASSENGER : 6 PERSONS

WIND PROPULSION : MASTS (3), SAILS(4)

MAIN ENGINE : FOUR-STROKE, NON-REVERSIBLE,

DIRECT FUEL INJECTION, ELECTRIC STARTING, TURBO CHARGED,

HIGH SPEED DIESEL ENGINE. ABT. 260 KW AT 100% MCR

Detailed information ready upon firm interest.

Hwang & Company, Ltd.

hwangnco@hwangnco.com

|